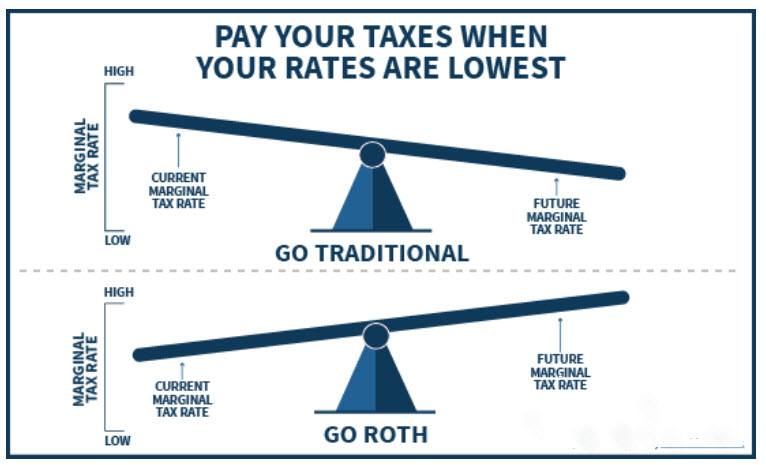

Here’s the simplest way to think about it—Traditional vs. Roth is mostly about when you pay taxes, and this applies to both IRAs and 401(k)s.

The core idea (works for IRA and 401(k))

- Traditional = tax break now, pay taxes later

You generally contribute pre‑tax (or deductible), money grows tax‑deferred, and withdrawals are taxed. - Roth = pay taxes now, tax‑free later

You contribute after‑tax, money grows tax‑free, and qualified withdrawals are tax‑free.

IRA: Traditional IRA vs Roth IRA (pros & cons)

Traditional IRA — pros

- Possible tax deduction now (if you qualify), which can lower your taxable income this year.

- Good if you think you’ll be in a lower tax bracket in retirement.

- Tax‑deferred growth until you withdraw.

Traditional IRA — cons

- Withdrawals are taxed as ordinary income.

- Required Minimum Distributions (RMDs) generally start at age 73 (current rule), meaning you’re forced to start withdrawing.

- Early withdrawals (before ~59½) can trigger penalties unless an exception applies.

- If you make non‑deductible contributions, tracking the “already taxed” portion can get paperwork‑heavy (Form 8606).

Roth IRA — pros

- Qualified withdrawals are tax‑free (you follow the rules).

- No RMDs during your lifetime if you’re the original owner—so you can let it grow longer.

- Flexibility: you can often withdraw your contributions (not earnings) more flexibly than in employer plans (rules still matter).

Roth IRA — cons

- No tax deduction today (you pay taxes upfront).

- Income limits can restrict who can contribute directly (this is a big difference vs Roth 401(k)).

- To get earnings tax‑free, you must meet qualified distribution rules (including a 5‑year rule and typically being 59½+).

401(k): Traditional 401(k) vs Roth 401(k) (pros & cons)

Traditional 401(k) — pros

- Contributions are usually pre‑tax, so you lower taxable income now.

- Often the easiest way to save a lot: higher contribution limits than IRAs (generally).

- Usually has conveniences like payroll deduction, and sometimes loans (plan-dependent).

Traditional 401(k) — cons

- Withdrawals are taxed as ordinary income.

- RMDs generally start at age 73, though many workplace plans let you delay RMDs until you retire (if you’re not a 5% owner).

- Early access is constrained; withdrawals before ~59½ may face penalties unless exceptions apply.

Roth 401(k) — pros

- Contributions are taxed now, and qualified withdrawals (including earnings) can be tax‑free.

- No income limits to contribute (unlike Roth IRA).

- Great for building “tax diversification” (some money taxable later, some not).

Roth 401(k) — cons

- No tax break today → your take‑home pay is usually lower.

- Withdrawal mechanics can be less flexible than a Roth IRA: nonqualified distributions are typically pro‑rata (part contributions, part earnings), which can create taxable income even if you only “wanted to pull contributions.”

- Investment options are limited to what your employer plan offers.

RMD note (important difference)

The IRS says Roth IRAs and designated Roth accounts (like Roth 401(k)/403(b)) do not have RMDs while the owner is alive.

(Traditional accounts generally do.)

Employer match: one key 401(k) detail

- Getting the full employer match is usually priority #1 (it’s “free money”), regardless of Traditional vs Roth.

- Historically, employer match often went into a pre‑tax bucket, but plans can allow matching/nonelective contributions to be treated as Roth under SECURE 2.0 rules (plan-dependent).

Quick “which one is better?” rule of thumb

- Choose Traditional (more) if:

You’re in a high tax bracket now and expect a lower one later, or you really value the deduction today. - Choose Roth (more) if:

You’re in a lower bracket now, expect higher taxes/brackets later, or want more tax‑free income in retirement. - Many people hedge by splitting contributions (some Traditional + some Roth) to avoid “all your eggs in one tax basket.”

Leave a comment